Nvidia vs AMD Stock in 2024: A Comprehensive Comparison of Semiconductor Stocks

Nvidia vs AMD Stock in 2024: A Comprehensive Comparison of Semiconductor Stocks

In the world of technology investments, few comparisons ignite as much interest as the ongoing battle between AMD vs Nvidia stock. With both companies at the forefront of innovation in the semiconductor industry, investors are eager to discern which offers the most promising prospects for future growth and profitability.

Key Facts:

- Both Nvidia and AMD have experienced significant stock price gains over the past year.

- The semiconductor industry is expected to see a 17% increase in revenue in 2024.

- Nvidia dominates the AI chip market, while AMD focuses on AI-enabled PCs.

- AMD’s gaming segment has faced challenges due to declining revenue, while Nvidia faces competition in the gaming graphics cards market.

- Investors are interested in both Nvidia and AMD, considering factors such as growth projections and valuation metrics.

How did the stock prices of Nvidia and AMD change in the past year?

Over the past year, both Nvidia and AMD have seen significant increases in their stock prices. Nvidia’s stock soared by an impressive 252%, while AMD saw a commendable gain of 128%. This surge reflects the overall strength of the semiconductor market, with investors optimistic about the future prospects of these companies.

What about the semiconductor industry in 2024?

The semiconductor industry is poised for growth in 2024, following a challenging period marked by declines in smartphone and PC markets. Projections suggest a 17% increase in global semiconductor revenue to $624 billion. This growth is driven by factors such as increased demand for AI-related technologies and a rebound in PC shipments.

What is one area where both Nvidia vs AMD stock are trying to grow their business?

Both Nvidia and AMD are eyeing the lucrative AI market. Nvidia has established itself as a dominant player in AI chips, with forecasts indicating continued rapid growth. The company’s revenue from data center business is expected to double in fiscal 2024, driven by strong demand for AI chips. On the other hand, AMD is making strides in AI-enabled PCs, positioning itself to capitalize on the market’s growth potential.

What are some challenges mentioned for AMD in the gaming segment?

While both companies have strengths, they also face challenges. AMD’s gaming segment has seen a decline in revenue due to tepid sales of its semi-custom chips used in gaming consoles. Nvidia, on the other hand, faces stiff competition in the gaming graphics cards market, with AMD struggling to gain traction.

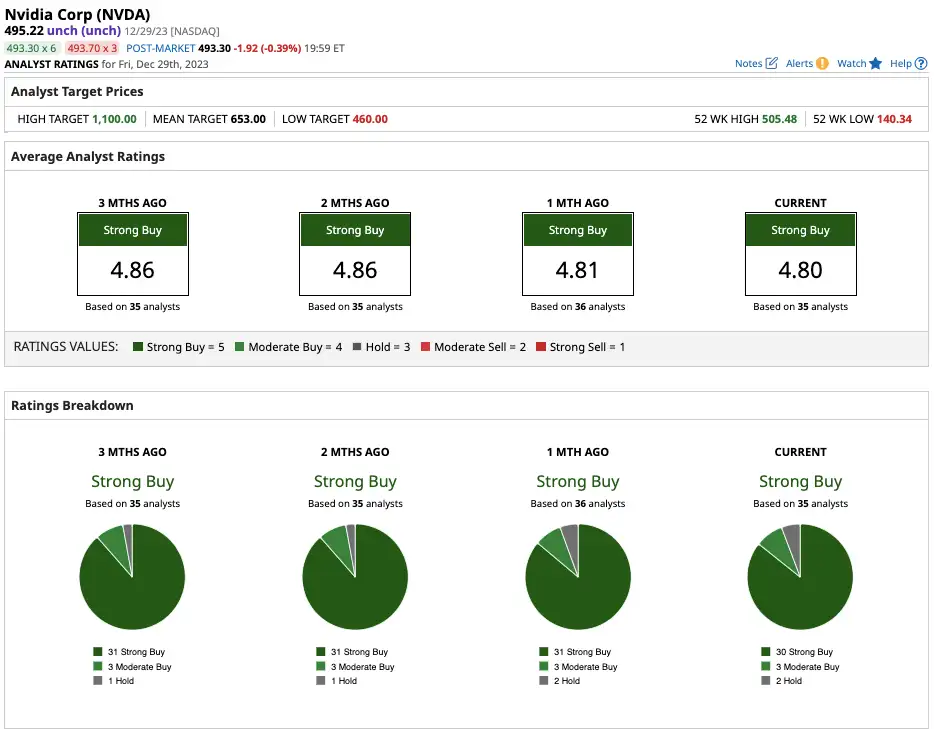

Why Nvidia might be a better investment option compared to AMD?

Nvidia may be considered a better investment option compared to AMD for several reasons:

- Market Dominance: Nvidia has established itself as a dominant player in key markets such as AI chips and gaming graphics cards. The company’s strong market position and technological leadership provide a competitive edge over its rivals.

- Growth Prospects: Nvidia’s growth prospects appear robust, particularly in the data center business. With increasing demand for AI-related technologies, Nvidia is well-positioned to capitalize on this trend and drive revenue growth in the coming years.

- Valuation: Nvidia’s valuation metrics may be more favorable compared to AMD, making it an attractive investment option for value-conscious investors. Despite its strong performance, Nvidia’s stock may be relatively cheaper based on forward and trailing earnings multiples.

- Future Outlook: Analysts and industry experts anticipate continued growth and success for Nvidia, driven by factors such as increasing demand for AI chips and gaming graphics cards. The company’s strategic initiatives and product innovations further support a positive outlook for future performance.

Overall, Nvidia’s market dominance, growth prospects, favorable valuation, and promising future outlook make it a compelling investment option compared to AMD. However, investors should conduct thorough research and consider their individual investment objectives and risk tolerance before making investment decisions.

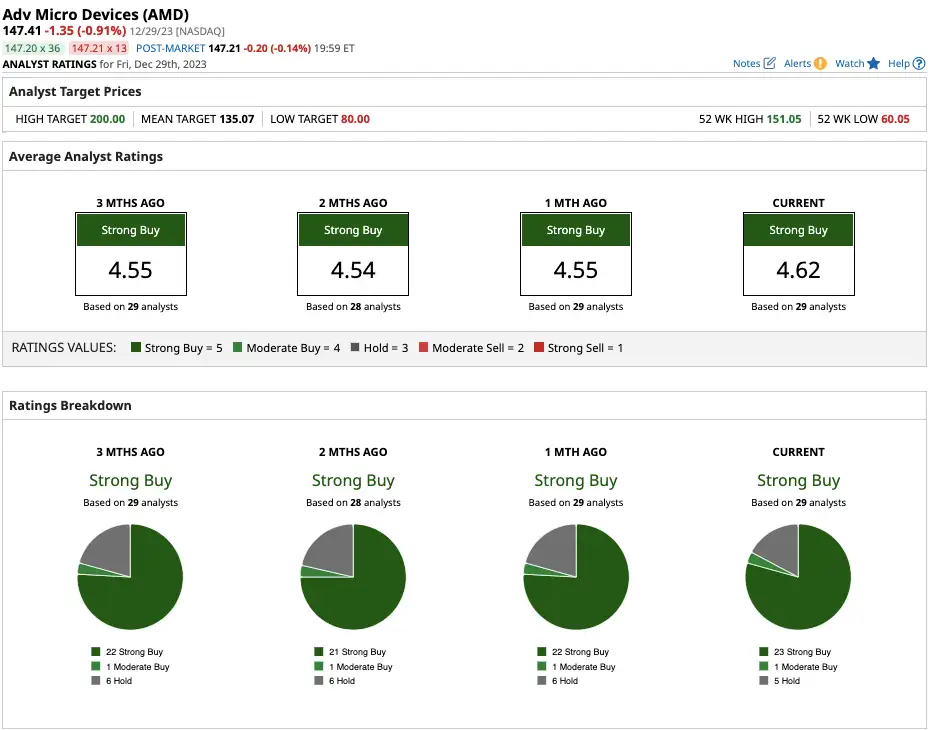

How does AMD plan to benefit from the recovery in the PC market?

AMD plans to benefit from the recovery in the PC market through several strategic initiatives:

- Product Portfolio: AMD offers a diverse range of products, including central processing units (CPUs), graphics cards, and semi-custom chips used in PCs and gaming consoles. By offering competitive and innovative products, AMD aims to capitalize on the increased demand for PCs as the market rebounds.

- AI-Powered PCs: AMD is positioning itself to tap into the growing market for AI-enabled PCs. The company’s CPUs power these computers, enabling advanced AI capabilities that cater to the evolving needs of consumers and businesses. As demand for AI-powered PCs continues to rise, AMD stands to benefit from increased sales of its processors.

- Market Expansion: AMD is focused on expanding its presence in key markets, including consumer and enterprise segments. By leveraging its technology and partnerships, AMD seeks to capture market share and drive growth in the PC market.

- Strategic Partnerships: AMD collaborates with leading PC manufacturers and technology partners to promote its products and expand its reach in the PC market. By forming strategic alliances and joint ventures, AMD aims to enhance its brand visibility and increase sales of its products in the recovering PC market.

Overall, AMD’s strategy to benefit from the recovery in the PC market involves offering innovative products, targeting emerging segments such as AI-powered PCs, expanding its market presence, and forming strategic partnerships. By executing these initiatives effectively, AMD aims to capitalize on the opportunities presented by the growing demand for PCs and drive growth in its business.

In conclusion, the ongoing debate of AMD vs Nvidia stock continues to captivate investors, each weighing the strengths and weaknesses of these semiconductor giants. As the technology landscape evolves, staying informed about the latest developments and market trends is crucial for making well-informed investment decisions.