Is Nvidia Stock a Buy Now? Navigating the Potential of Nvidia Stock

Potential of Nvidia Stock: Is Nvidia Stock a Buy Now?

As investors navigate the dynamic landscape of the stock market, one question looms large: Is Nvidia Stock a Buy? In this analysis, we’ll delve into the intricacies of Nvidia’s performance, market standing, and growth prospects to provide clarity on whether now is the right time to invest in Nvidia. Navigating through the world of investments can be daunting, but understanding Nvidia’s trajectory and market dynamics can help make informed decisions. Let’s explore further.

Key Facts:

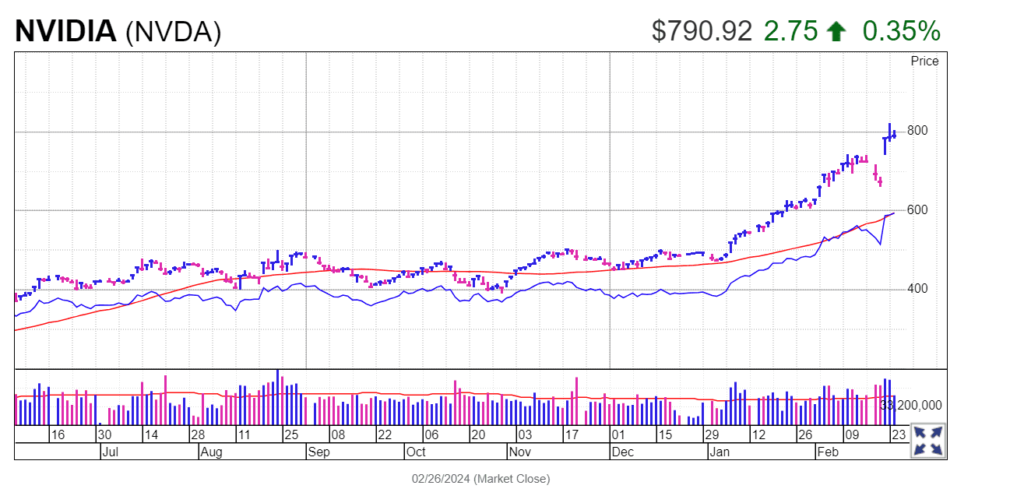

- Nvidia has experienced significant stock growth, with over a 210% increase since January 2023.

- The company’s dominance in GPUs and AI chips has led to substantial revenue and free cash flow growth in the past year.

- Despite increasing competition from companies like AMD and Intel, Nvidia maintains a strong market share, particularly in AI GPUs.

- Market trends indicate continued growth in the AI market, with Nvidia well-positioned to benefit from this expansion.

- Analysts project a potential rise of more than 90% in Nvidia’s stock over the next two years.

- Despite potential challenges, analysts project substantial upside potential for Nvidia’s stock, indicating that Nvidia Stock is a buy for investors seeking exposure to the forefront of technological innovation.

What recent achievements has Nvidia celebrated?

Nvidia has celebrated significant achievements, including remarkable growth in its stock price, with an increase of over 210% since January 2023. Additionally, the company has experienced impressive financial results, with quarterly revenue and free cash flow soaring by 200% and 360%, respectively, in the last 12 months. These achievements underscore Nvidia’s continued success and market leadership in the realm of graphics processing units (GPUs) and artificial intelligence (AI) chips.

How much did Nvidia’s stock rise since January 2023?

The explosion of AI technologies has fueled Nvidia’s growth trajectory. As demand for AI chips skyrocketed, Nvidia’s quarterly revenue and free cash flow surged by 200% and 360%, respectively, in the last 12 months. Despite increasing competition from the likes of AMD and Intel, Nvidia’s stronghold in the AI chip market remains unshakeable.

What do market trends suggest about Nvidia’s dominance in the AI chip market?

While competitors like AMD and Intel have entered the AI chip market, Nvidia’s supremacy seems difficult to challenge. With a market share of over 80% in desktop GPUs, Nvidia has maintained its lead despite the presence of established players. Even newcomers like Amazon and Microsoft face an uphill battle to compete with Nvidia’s dominance.

What are some examples of Nvidia’s partnerships?

Some examples of Nvidia’s partnerships include collaborations with companies like Dell Technologies and Lenovo for the integration of Nvidia’s advanced chips into portable workstations. Additionally, Nvidia has partnered with other industry players to accelerate video streaming and other content-related tasks. These partnerships highlight Nvidia’s strategic efforts to expand its reach and leverage its technology across various sectors and applications.

What is the projected growth rate of the AI market until at least 2030?

The projected compound annual growth rate (CAGR) of the AI market is an impressive 37% until at least 2030. This robust growth forecast indicates a significant expansion in the demand for artificial intelligence technologies across various sectors. As AI continues to permeate industries such as healthcare, automotive, finance, and more, the reliance on AI chips, such as those produced by Nvidia, is expected to surge. This sustained growth trajectory underscores the immense potential for companies like Nvidia to capitalize on the evolving landscape of AI-driven technologies and solidify their position as key players in the market.

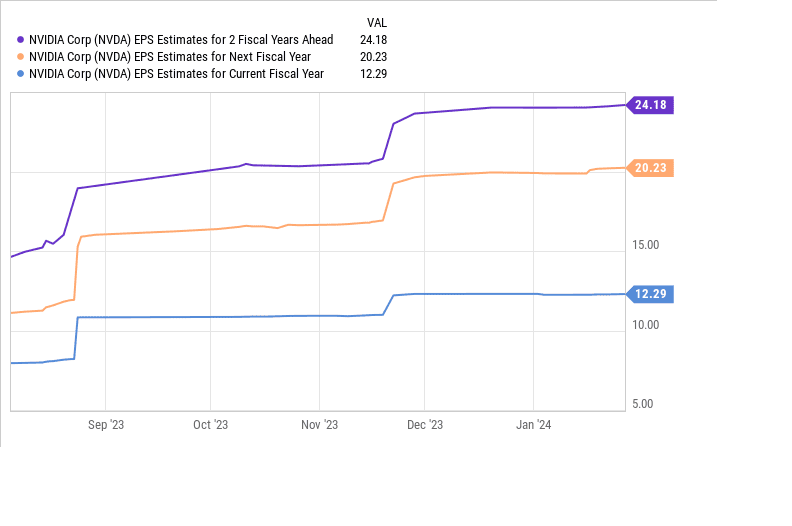

What is the company’s estimated EPS by fiscal 2026?

For investors eyeing Nvidia stock, there are several factors to consider. Despite its impressive growth, Nvidia’s stock may not replicate last year’s performance. However, with an estimated EPS of $24 by fiscal 2026, analysts project a potential rise of 96% in Nvidia’s stock over the next two years.

In Conclusion:

In conclusion, the question of whether Nvidia Stock a Buy boils down to a nuanced understanding of the company’s performance and market dynamics. Despite facing competition and uncertainties, Nvidia’s strong fundamentals and innovative products make it a compelling investment choice. With promising growth prospects and a track record of success, Nvidia Stock a Buy for investors seeking exposure to the forefront of technological innovation.